Macroeconomics: This branch emerged in the 1930's in response to the challenges of the Great Depression and the consensus failure of economics/microeconomics to address these policy challenges. The goal of macroeconomics is about the development of data, tools and the determination of policy to guide aggregate economic activity. These tools, and the models behind them, are based on solid microeconomic understanding. In the absence of the need for this policy, there would be little use for the tools of macroeconomic analysis. This, of course, is not always the case. In my opinion, macroeconomic analysis is better treated as a field of economics (like: labor economics, international trade, urban economics, among others) rather than a branch equal-to, and separate from microeconomics.

Navigate via the: Glossary

1. Basics

0. Economics as a Social Science2. Macroeconomic Measures

0. Measures of Economic Activity3. Capital, Wealth and Living Standards

0. Capital and Wealth4. The Ability to Spend

0. the Ability to Spend5. Aggregate Consumption

0. Consumption Decisions6. Investment Decisions

0. Investment Decisions7. Interest Rate Determination

0. Nominal and Real Interest Rates8. Financial Markets

0. Financial Markets9. The Ability to Produce

0. The Abilty to Produce10. Economic Policy

0. Economic Policy

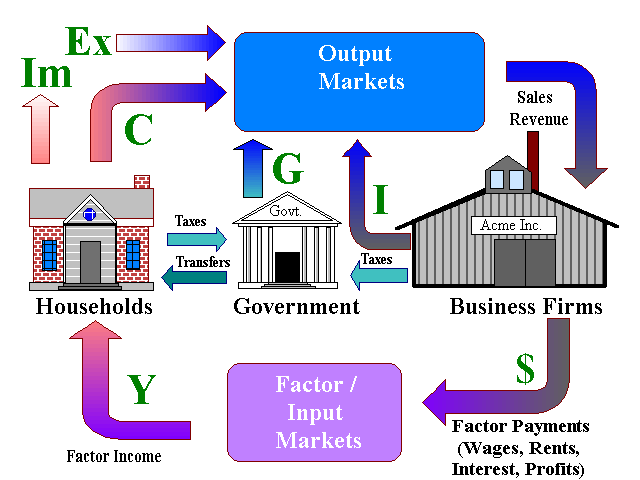

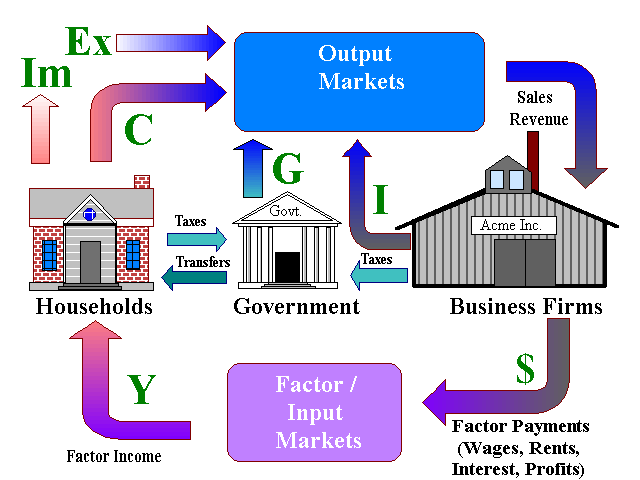

The circular flow diagram for a macroeconomy include four major players; households, business firms (producing private goods and services), government (providing public goods and services) and the international sector -- other nations that trade with the domestic economy.

Much of the trading activity takes place either in output markets -- where goods and services are bought and sold or in input markets -- where factor inputs (labor, capital, resources...) are bought and sold. Because we are measuring activity in the aggregate, the emphasis is on expenditure flows measured in currency terms -- expenditure can be aggregated where as quantities of different types of goods can not be lumped together.